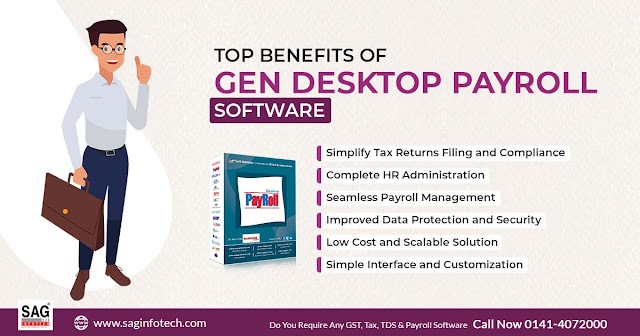

In today's competitive business world, optimising payroll procedures is essential for efficiency, cost reduction, and compliance with tax laws. Gen Desktop Payroll Software stands out as a comprehensive solution suitable for businesses of any scale, offering an array of features that simplify payroll management and improve HR functions.

What are the Advantages of Using Gen Desktop Payroll Software?

Mentioned below are some of the different features of the Gen payroll software for HR Administration -

#1. Simplify Tax Returns Filing and Compliance

Remaining updated with evolving tax regulations, the software ensures businesses adhere to all statutory requirements. It automatically computes and deducts various taxes such as TDS, PT, and local taxes, simplifying tax compliance and mitigating the risk of penalties. Moreover, it facilitates effortless e-return filing for PF, ESI, and other obligatory filings, ultimately saving time and simplifying these processes.

#2. Complete HR Administration

Going beyond payroll processing, Gen Desktop Payroll Software expands its functionalities to cover a broad spectrum of HR management tasks. It serves as a centralised hub for employee information, encompassing personal details, attendance logs, leave administration, and investment tracking. This consolidated data equips HR professionals to make well-informed decisions, streamline the onboarding process, and efficiently oversee employee performance.

#3. Seamless Payroll Management

This software eradicates the complexities of manual payroll calculations by automating the entire process, from data input to generating payslips. It effortlessly manages different salary structures, deductions, and taxes, ensuring precise and prompt payroll processing. By automating these tasks, it not only saves time and resources but also reduces the chances of errors, enhancing accuracy and ensuring compliance.

#4. Improved Data Protection and Security

Gen Desktop Payroll Software places a high premium on data security by fortifying sensitive employee information with strong encryption protocols and access controls. Employing role-based permissions, it guarantees that only authorised personnel can access and modify employee data. Routine data backups and disaster recovery protocols add an extra layer of protection against data loss, ensuring uninterrupted business operations.

#5. Low-Cost and Scalable Solution

With a variety of pricing options available, it caters to businesses across different sizes and budget constraints. Its scalability ensures the software can flexibly adjust to accommodate the evolving needs of businesses, whether it's handling a growing workforce, expanding payroll intricacies, or both.

#6. Simple Interface

Its user-friendly interface is intuitive, ensuring easy navigation for both technical and non-technical users. The software's design enables businesses to tailor it to their exact specifications, accommodating distinct payroll structures, deduction plans, and reporting necessities.

Closure

SAG Infotech Gen Desktop Payroll Software for HR Management emerges as a robust solution for businesses aiming to streamline payroll, bolster HR functions, and maintain tax compliance. Its wide-ranging features, ease of use and affordability position it as an ideal option for businesses of any scale, spanning from fledgling startups to expansive enterprises.

Through this software, companies can simplify payroll operations, trim expenses, and enable their HR departments to concentrate on strategic endeavours that drive growth and achievement.

Comments

Post a Comment