A tax expert answers the question- ‘the requirements of advance tax provisions under the Income-tax Act 1961’. Advance tax, as the name itself indicates that the tax paid by individuals in the financial year when the corresponding income is earned, rather than in the assessment year when the income is assessed for taxation purposes. This payment is calculated based on the consolidated income earned and expected to be earned from various sources, such as salary, rent, interest, and more. It takes into account applicable deductions, exemptions, and credits for taxes deducted at source (TDS) or taxes collected at source (TCS).

According to section 208 of the Income Tax Act, 1961, individuals whose estimated tax liability for the year amounts to Rs. 10,000 or more are required to pay advance tax. However, senior citizens aged 60 years or above who are residents and do not earn any income from business or profession are exempt from paying advance tax.

Typically, advance tax payments are made in specified installments every quarter, with due dates to be met to avoid interest consequences. However, professionals such as doctors, lawyers, architects, etc., who have opted for the presumptive scheme under sections 44AD or 44ADA of the IT Act, are obligated to pay their entire advance tax liability in a single installment by March 15th of the relevant financial year, instead of quarterly payments like other taxpayers.

Taxpayers who couldn't submit their advance tax payments before the deadline mentioned above would be liable to bear the consequences and interest penalties stated below:

Interest Under Section 234B of the Income Tax Act

If a taxpayer is required to pay advance tax under Section 208 of the IT Act and either fails to do so or pays an amount less than 90% of the assessed tax, they will be liable to pay simple interest at a rate of 1% per month or part of a month for the default in payment of advance tax. This interest will be calculated starting from the first day of the assessment year, which is April 1st after the end of the financial year, and will continue until the date when the income is determined under Section 143(1) or until the date of a regular assessment if conducted. It is important to note that any tax paid before March 31st will be considered as advance tax.

Interest under section 234C of the Income Tax Act

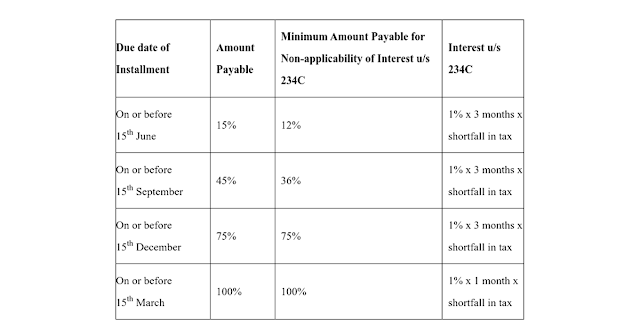

Section 234C of the IT Act imposes interest for the failure to pay or underpayment of installments of advance tax. This interest is calculated at a rate of 1% simple interest per month or part of a month for each individual installment that is not paid in full or not paid at all. The application of interest under Section 234C for deferred installments of advance tax is as follows:

For taxpayers who have opted for the presumptive taxation scheme under Section 44AD or 44ADA of the IT Act, interest will be charged if the advance tax paid on or before March 15th is less than 100% of the advance tax payable.

However, no interest will be levied on the shortfall if taxpayers have paid the minimum amount due on or before the specified due dates. Additionally, taxpayers will not be liable for any interest under Section 234C of the IT Act if the shortfall in tax payment is due to certain specified incomes such as capital gains, etc. If the taxpayer pays the required advance tax on such income as part of the immediate following instalments or before March 31st, if no instalment is pending, they will not incur any interest liability.

Comments

Post a Comment