Managing Tax Deducted at Source (TDS) is a critical aspect of tax compliance for both businesses and individuals in India. It involves intricate calculations, deductions, reporting, and filing, necessitating precise solutions due to its complexity and evolving regulations.

SAG Infotech's Gen TDS software has gained significant recognition in the Indian market for its comprehensive features and tools designed to simplify TDS compliance. In this overview, we'll explore the key attributes, benefits, and importance of Gen TDS software within the tax context.

What is Tax Deducted At Source (TDS)?

In India, the government employs Tax Deducted at Source (TDS) to gather taxes from various income sources. Essentially, when making payments to recipients, a specific percentage of tax is deducted by the payer and then remitted to the government. TDS applies to various types of income, such as commissions, rent, interest from fixed deposits, salaries, and more. Understanding TDS is crucial for both those paying income and those receiving it in India, as it plays a pivotal role in preventing tax evasion.

It's vital to withhold TDS at the rates specified by the tax department. The entity or individual receiving the payment is known as the deductee, while the entity or individual making the payment after deducting TDS is termed the deductor.

What is the Primary Role of Gen TDS Software?

Gen TDS software stands as a specialised solution crafted to enhance and streamline the intricate TDS compliance process. Catering to a diverse range of users, such as businesses, chartered accountants, tax professionals, and individuals, this tool effectively manages TDS responsibilities.

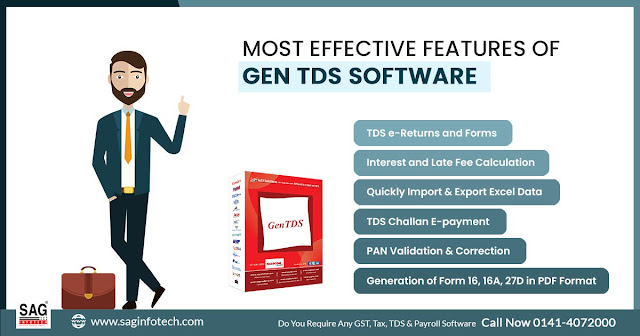

Significant Factors of Gen TDS Software

Outlined below are the crucial aspects of Gen TDS/TCS return filing software in India for taxpayers:

#1. Filing of TDS Returns

Supporting electronic filing of TDS returns and certificates, Gen TDS software aligns with the government's initiative to digitize tax-related processes.

#2. TDS Computation

This software efficiently computes TDS figures automatically, considering pertinent tax rates and thresholds. Such a feature significantly simplifies the intricate task of TDS calculation, ensuring precision and accuracy in the process.

#3. Generate TDS Certificates and Form

Gen TDS software creates TDS certificates and forms like Form 16, Form 16A, Form 27D, and more, meeting the requirements set by the Income Tax Department.

#4. Automatic Tax Deduction

Gen TDS software streamlines the deduction process, simplifying the accurate deduction of TDS amounts from payments to vendors, employees, or other beneficiaries for businesses.

#5. Importing Bulk Data

Users can import large volumes of data, reducing manual entry needs and minimising errors in TDS calculations and returns.

#6. Verify Online TDS Details

The software verifies TDS details online to ensure the accuracy of submitted data, aligning with tax authority records.

#7. Integration with TRACES Portal

The software seamlessly integrates with the TRACES portal, facilitating the reconciliation of TDS statements with departmental records.

#8. E-payment of Challan

The facility to generate an online e-payment challan verification is available.

#9. Generation of Report Facility

The software also generates different reports in single or bulk mode, salary certificates, challan-wise information, deductee-wise payment, and clients not having PAN and Address, Etc.

#10. Interest and Late Fee Calculation

It has an option for automatic calculation of interests and late fees.

Advantages of Gen TDS Software

Below are several benefits of Gen TDS software:

- Error Minimisation: The software reduces the risk of errors in TDS calculations, preventing penalties or discrepancies in tax records.

- Time Efficiency: Automating TDS calculations, deductions, and return filing saves valuable time for businesses and tax professionals.

- Reporting Simplification: The software streamlines the generation and filing of TDS returns, making it accessible even to those with limited tax knowledge.

- Data Security: It provides a secure platform for managing sensitive financial data, ensuring confidentiality and data integrity.

- Legal Compliance: Gen TDS software ensures adherence to current tax laws, decreasing the likelihood of non-compliance issues.

- Cost-Effectiveness: Utilising Gen TDS software eliminates the need for manual record-keeping, minimising TDS compliance costs.

Importance of Gen TDS Software in Tax Compliance

In an era of increasing digitization in the Indian tax system, reliable and efficient TDS software is crucial. Gen TDS software has become an indispensable tool in this evolving landscape.

It empowers businesses and individuals to manage their TDS responsibilities effectively while keeping pace with dynamic tax regulations. By automating and simplifying the entire TDS process, the software aids users in staying compliant, avoiding penalties, and contributing to a more transparent and efficient tax ecosystem.

Closure

Gen TDS software stands as a crucial element within India's contemporary tax compliance framework. Its extensive functionalities, time-efficient operations, and commitment to legal adherence render it indispensable for businesses, tax professionals, and individuals.

Amid continually changing tax statutes and the government's dedication to digital innovation, SAG Infotech Gen TDS/TCS software assumes a central role in streamlining TDS compliance. It minimises errors, ensures accurate tax deductions, and facilitates timely reporting. As tax laws advance, Gen TDS software remains a leading technology-driven solution for tax compliance.

Comments

Post a Comment