Explanation of 15 Digits GSTIN or GST Number

A unique TIN number was assigned by each state tax authority to all dealers registered under state VAT laws before GST implementation. As an example, the CBIC assigned service providers a number identifying them as service providers.

Each registered taxpayer is consolidated under the GST regime into one single platform and assigned registration under one authority for compliance and administration purposes.

Businesses operating in states and union territories will be issued a GSTIN (Goods and Services Tax Identification Number).

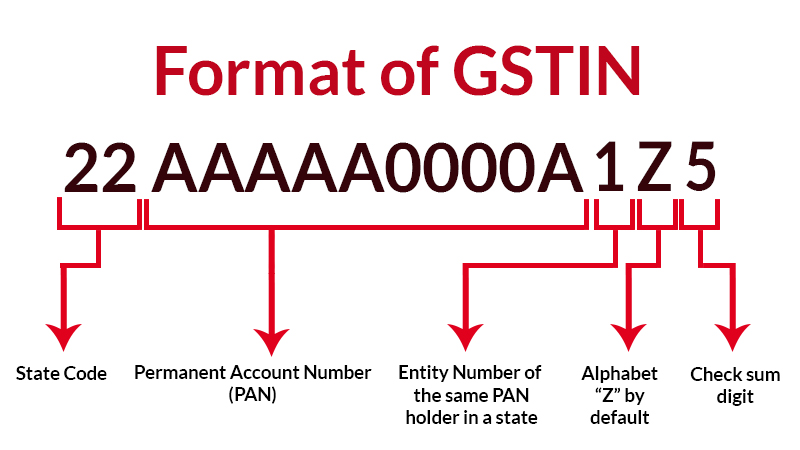

How GSTIN is Structured

In order to determine a taxpayer's eligibility for Goods and Services Tax, the state assigns a 15-digit PAN-based GSTIN.

- In accordance with the Indian Census 2011, the first two digits correspond to the state code. There is a unique code for every state. The following are some examples:

- There is a 29-digit state code for Karnataka

- Delhi has the state code 07

- A taxpayer's PAN number will appear after the next ten digits

- Based on the number of registrations within a state, the thirteenth digit will be assigned

- There will be a default fourteenth digit of "Z"

- A check code will appear as the last digit. A number or an alphabet may be used.

What is the GSTIN Application Process?

In order to register for GST, you must complete this step. An individual GSTIN is assigned to the dealer once the application is approved by the GST officer.

GST Registration Can Be Done in Two Ways:

- via Government GST Online Portal or

- via Authentic GST Seva Kendra

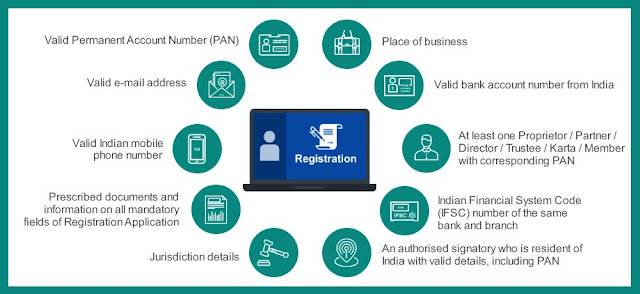

To apply for GST, you must provide the following details:

Cost to Get a GSTIN

Registration for GST and obtaining GSTIN are free of charge.

What is the difference between GSTIN and GSTN?

It is important not to confuse GSTIN with GSTN. GSTIN is a number that is used to register for GST. In opposition to this, the GSTN is the organisation responsible for managing all the IT infrastructure and systems related to the GST portal. Using this portal, the Government of India will be able to track every financial transaction and provide a range of tax-related services to taxpayers, including registration, filing, and maintenance.

Comments

Post a Comment