|

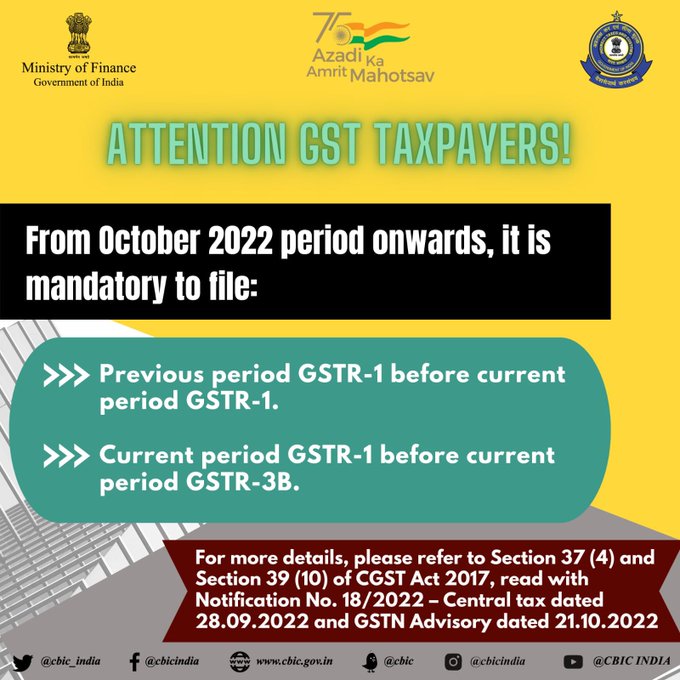

A taxpayer is not able to open the GSTR-3B form of October 2022 on the GST Common Portal if the GSTR-1 form of the same tax period October 2022 is not filed yet. CBIC has warned taxpayers via tweet with brief details.

A taxpayer who has not furnished the GSTR-1 for the previous period including the current period will not be able to file the GSTR-3B form for the current period.

Sections 37 & 39 of the Central Goods and Service Tax Act (CGST), 2017 have been amended by the Central Government vide Notification No. 18/2022-Central Tax dated 28th September 2022 with effect from the 1st of October, 2022.

In accordance with section 37(4) of the CGST, Act, taxpayers who have not filed GSTR-1 for a previous tax period shall be barred from filing GSTR-1, and in accordance with section 39(10), taxpayers who have not filed GSTR-3B for the same period shall not be permitted to file GSTR-3B.

Unless a registered person has furnished the details of outward supplies for any of the previous tax periods, a registered person shall not be able to furnish the details of outward supplies for the current period. Unless the details of outward supplies have been submitted under sub-section (1) of section 37 for the said tax period, the registered person will not be able to furnish a return for a tax period under Section 39(10).

Comments

Post a Comment