On the web portal of GST, Form GSTR-2B is an ‘automatically drafted Input Tax Credit Statement’ that shall be displayed for each registered person on the criteria of the information that is furnished by his suppliers in their corresponding.

- GSTR-1

- GSTR-5 (Non-resident taxable person)

- GSTR-6 (Input Service distributor)

GSTR-2B is a static statement (unlike GSTR-2A that is dynamic) and is made available every month. The day of disclosure is the 12th day of the next month implying that no changes shall be made after the 12th day of the next month in GSTR-2B.

Attributes of GSTR-2B

- Details about the import of goods made available from ICEGATE System: The GSTR-2B Statement provides details on the import of goods that are brought from the ICEGATE system that is inclusive of details about the inward supply of goods from the units or developers of Special Economic Zones(SEZ). Nevertheless, it is not included in the released version of the GSTR-2B for July month. Yet it shall be made available soon.

- Summarised Statement: It is a statement that indicates whether all the input tax credit is made available or unavailable under each section. The advisory is provided for each section that makes a clarification about the steps/action that can be undertaken by the taxpayers in the particular section as per GSTR-3B.

- Document Level Details: It includes document-level details of all the invoices, credit and debit notes, and so on along with options to view and download.

How to View and Download Form GSTR-2B?

Step 1: Firstly, Open a browser and google https://www.gst.gov.in/ and open the consequent web page. Thereafter login to the GST portal by inputting your valid credentials. Then click on

Step 2: In this step, the ‘File Returns page’ shall open. Then using the drop-down menu, opt for the Financial Year & Return Filing Period (Month) for which you wish to view/download GSTR-2B. Afterward, Click on the SEARCH button. Form GSTR-2B tile ( ITC Statement named GSTR 2B)shall be displayed with two options i.e. View and Download.

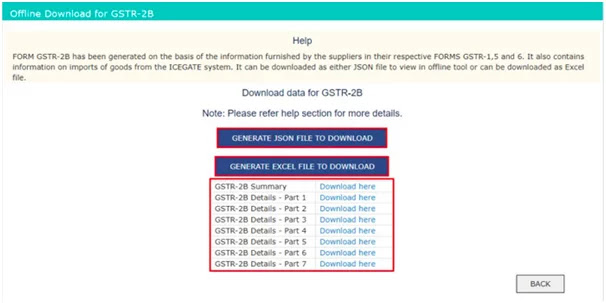

Step 3: Here .in this step download GSTR-2B. It is worthwhile mentioning here that if they're more than 1000 documents appear under all tables of Form GSTR-2B, then ‘document all the details’ can be downloaded in Excel / JSON format from the download option. Thereafter Click on the DOWNLOAD button to download the form GSTR-2B.

Step 4: In this final step, either click Generate JSON File to download button or Create an excel file to download button to download the Form GSTR-2B. The file shall be downloaded and then stored on your drive.

Step 5: If in case you just need to view the Form, then Under the Form GSTR-2B title, click on the VIEW button.

Step 6: Finally, after clicking the option Form GSTR-2B Auto Drafted ITC Statement page will appear.

Comments

Post a Comment