Did you receive a questionable GST notice? Do not panic! This article can help you spot bogus GST summonses and avoid difficulties. Let's go explore!

Identifying a False GST Summons or Tax Notice

A fake GST summons or tax notice is a forgery intended to resemble genuine government mail, usually from tax officials. The goal is to persuade recipients to make superfluous payments or disclose personal information.

Scammers use your fear of penalties or additional charges to compel you to take immediate action without considering its legitimacy. Before replying to such letters, always check with the appropriate government authority.

Overview of DGGI's Advisory

The collaboration between the CBIC and the DGGI aims to uphold GST laws and prevent fraudulent activities.

Their most recent advice, issued on February 10, 2024, intends to help taxpayers identify and address bogus GST communications. This guidance aims to improve consumers' and enterprises' awareness of GST legislation while protecting them against fraudulent schemes, supporting a safer approach to addressing GST-related matters.

How to Verify Counterfeit GST Summons and Notices?

Determining the authenticity of GST summons and notices might be difficult, but we provide two simple approaches for quickly verifying their legitimacy without requiring any complicated procedures.

Method 1: Verifying the CBIC Document Identification Number (DIN)

- Spot the Document Identification Number (DIN): First, find the DIN on the document. Typically, it's displayed in "CBIC-YYYY MM ZCDR NNNN" format.

- Go to the CBIC Website: Use the DIN to access the official CBIC portal. Go to the 'Online Services' tab and choose the 'Verify CBIC DIN GST' option.

- Enter the DIN Number: Enter the detected number into the DIN area and supply the characters shown below.

- Authenticate Document: Click on the "Submit" button. The system will provide a confirmation message indicating whether the document is genuine or fake.

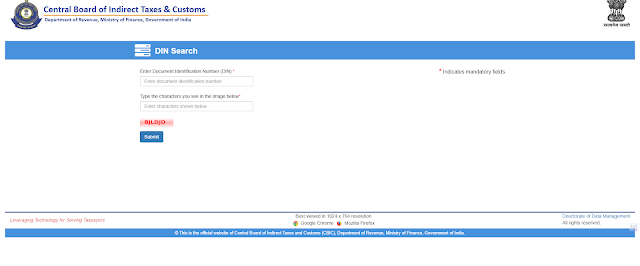

Method 2: Using the DIN Utility Search on the CBIC DDM Portal.

- Visit the online portal of the Directorate of Data Management (DDM), CBIC.

- Locate the DIN Utility Search feature on the portal.

- Input the DIN from your document to authenticate it.

Method 3: Reach Out to Jurisdictional Authorities

- Find the authorised contact information on the CBIC or DGGI websites. Refrain from relying on the information supplied in the questionable paper.

- Reach out to them via phone or email, providing the details of the notice or summons you received.

- Request confirmation regarding the authenticity of the document.

What Steps Should be Taken if the Summons is Found to be Counterfeit?

- Remain Calm & Refrain from Responding: To begin, keep your composure and resist sharing any personal information or reacting to the message.

- Gather Evidence: Keep all pertinent communications, including emails and letters, as proof.

- Report the Incident: Notify the appropriate authorities, such as the CBIC, DGGI, or local law enforcement, about the counterfeit alert.

- Spread awareness: Inform people about scams to keep them from falling victim.

- Seek assistance: Consulting with an expert can provide valuable guidance and support.

- Stay Vigilant: To protect yourself from potential hazards, keep up to date on developing frauds.

Comments

Post a Comment