The 50th meeting of the GST Council last month introduced numerous fresh updates and changes to the GST law. Alongside decisions about GST rates on goods and services, the Council discussed the taxation on several resources. Additionally, the Council proposed modifications to the GST law to simplify compliance, particularly suggesting using DRC-01C forms to address disparities between GST returns.

Among these forms, a recent notification this month proposed an alteration to the Central Goods and Services Tax (CGST) Rules, introducing a new form known as DRC-01C. This form's implications and its effects on businesses are outlined below.

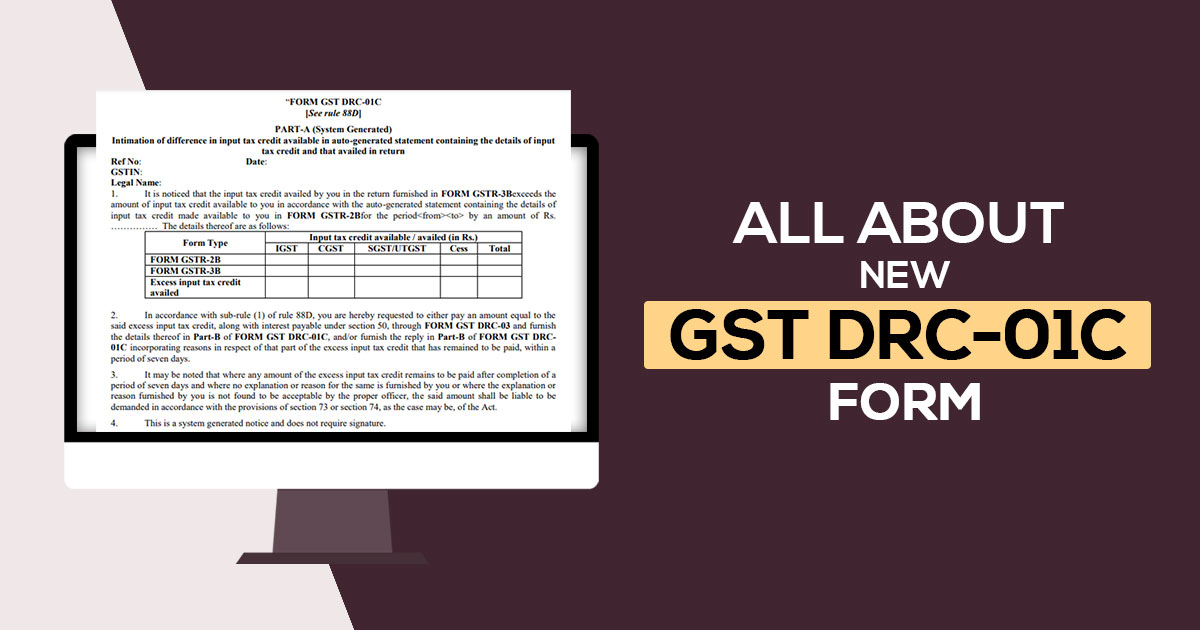

Difference Between GSTR-2B & GSTR-3B Form of DRC-01C

Central Tax Notification 38/2023 recommended the inclusion of Rule 88D, which outlines how differences in input tax credit (ITC) within GST returns will be managed. As per this rule, if the ITC claimed in GSTR-3B exceeds that available in GSTR-2B by an amount or percentage specified by the government, an automated intimation will be sent to the relevant taxpayer. This intimation will be dispatched in the form of DRC-01C.

Two Ways Through Which the Taxpayer Can Respond to the Intimation

- The first option available to taxpayers is to make a payment that equals to the excess Input Tax Credit (ITC) demanded in GSTR-3B, along with the applicable interest under Section 50. This payment should be made using Form GST-DRC-03.

- The second option is to provide an explanation for the discrepancy in ITC on the GST portal.

It is crucial to keep in mind that regardless of the chosen course of action, it is mandatory for taxpayers to submit a response using Part B of the same GST Form DRC-01C within a seven-day period. In case of failure to respond or an inadequate response may result in the initiation of demand and recovery proceedings by the tax authorities under the GST law.

What are the Implications of This Recent Modification in the Law for Taxpayers?

Form DRC-01C is not the first form used to auto-initiate GST taxpayers about discrepancies in returns. A few months ago, the government launched a similar Form DRC-01B for discrepancies between GSTR-1/IFF and GSTR-3B. DRC-01C is another such form and affects taxpayers who are negligent in reconciling their input tax credit before filing their GSTR-3B.

Receiving an intimation in Form DRC-01C can have adverse consequences for taxpayers due to various reasons:

- In most cases, along with the intimation in Form DRC-01C, taxpayers will also receive a demand notice for the difference in claimed ITC and the corresponding interest under Section 50. This can significantly impact the cash flow of a business.

- By failing to promptly reconcile their input tax credit and maintain effective communication with vendors, taxpayers may receive an intimation regarding differences between GSTR-2B and GSTR-3B, even if the fault lies with the vendors for not uploading invoices.

- If taxpayers do not respond within the stipulated seven-day period, it may lead to the initiation of demand and recovery proceedings under the GST law, resulting in unnecessary stress and unforeseen expenses for the enterprise.

Introducing the new Form DRC-01C focuses on the significance of speedy reconciliations and proactive interaction with vendors, tasks seamlessly carried out through automated GST filing solutions. The use of automated return scrutiny promotes proactive compliance instead of reactive measures. Failing to recognize errors in time will only have adverse effects on business. Automated solutions provide features like automatic data entry, simplified reconciliations, and GST filings with just a single click, eliminating the requirement for manual intervention and reducing human errors.

New E-Way Bills for Intra-State Movement of Particular Goods

The CBIC has stated that generating Part A of e-way bills will now be obligatory for transporting gold and precious stones within an Indian state or Union Territory. According to the notification, this rule applies when the consignment's value exceeds Rs. 2 lakh. However, the decision to set the threshold limit lies with the Commissioner of State tax or Union Territory tax.

If goods are supplied through an e-commerce operator or courier agency, they may input information in Part A of form GST EWB-01. Generating Part B (transporter details) of the e-way bill is unnecessary.

Additionally, creating an e-way bill is not mandatory when goods are transported from a customs port, airport, land customs station, or air cargo complex to a container freight station or an inland container depot for clearance by customs. This also includes scenarios where goods are transported under a customs bond, including movement between customs stations or ports, under customs supervision, or a customs seal.

Comments

Post a Comment