It is obligatory for the companies to convey to the Registrar of Companies (ROC) the appointment of the auditor via Form ADT-1 under the Companies Act 2013. For ADT-1, the same article furnishes a complete overview of the filing fees, the filing form procedure with the Ministry of Corporate Affairs (MCA), the last date of submission, and the required documentation needed to file the ADT-1.

At What Time to File Form ADT-1 with MCA?

Form ADT-1 should get filed with the Registrar of Companies (ROC) within 15 days of the Annual General Meeting (AGM) at which the auditor was appointed or reappointed under the Companies Act 2013. For the companies that are new the time duration is 15 days of the first board meeting which must be conducted within 30 days of the establishment for filing the form.

Facts for Filing Form ADT-1

- The filing obligation of Form ADT-1 counted with the company and not the auditor.

- For every sort of company along with listed, private, public, and unlisted the filing Form ADT-1 is obligatory.

- Form ADT-1 should get filed when the auditor would be hired for a casual vacancy in the company.

- For the first auditor appointment, it does not obligatory to file Form ADT-1, the same would be suggested to perform.

Necessary Document for Form ADT-1 Filing

The mentioned below are the documents to be attached to Form ADT-1-

- For the appointment, the written approval of the auditor.

- Company board resolution copy or a resolution issued in AGM.

- Auditor certificate assuring their eligibility and not being disqualified under section 141.

- Company’s disclosure copy to the auditor.

Form ADT-1 with MCA Filing Procedure

The procedure to file Form ADT-1 would be stated as-

- Get a digital signature certificate (DSC).

- Get a director identification number (DIN).

- From the MCA website, Download Form ADT-1

- Fill in the company’s name, registered office address, and additional needed information.

- Furnished the information of the appointed or reappointed auditor along with their name, address, PAN, and membership number.

- The essential documents must be attached like the board resolution for auditor appointment and the consent letter of the auditor.

- Validate the form through the DSC of the signing director.

- Submit the form electronically to the Registrar of Companies (ROC) after verification.

- Post submission, pay the fee for Form ADT-1.

- An acknowledgment shall get sent to the registered email address, on the successful submission and payment of fee.

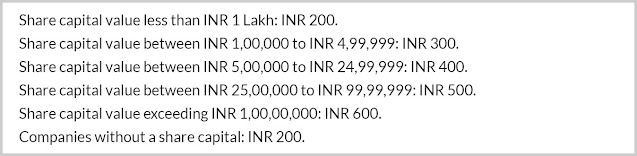

Form ADT-1 Filing Fee Structure

As per the share capital value of the company, the structure of the fee for filing Form ADT-1. The fee structure would be stated as-

Additional Annual Compliance for Private Limited Companies

Private limited companies in India secure annual compliance needs beyond filing Form ADT-1, these are-

- Annual General Meeting (AGM): Private limited companies should conduct an AGM within 6 months from the finish of their financial year to present financial statements, appoint/reappoint directors, and declare dividends.

- Financial Statements: Private limited companies should draft audited financial statements, along with a balance sheet, profit and loss account, cash flow statement, and notes to accounts.

- Income Tax Returns (ITR): ITR should get filed within the due date i.e. 31st July by the private limited companies whatever the profitability.

- Annual Return Filing: The private limited companies should furnish their yearly return including the Registrar of Companies (ROC) within 60 days from the AGM due date, furnishing the information on shareholding, directors, and additional legal details.

Closure

Form ADT-1 is required for the appointment of an auditor in a corporation and should get filed within the timeframe given. Except for the initial visit, all types of businesses must file Form ADT-1. It is the obligation of the company to filing the form with the ROC return to inform them of the auditor's appointment. Compliance with these conditions guarantees that legal duties and regulatory frameworks are followed.

Comments

Post a Comment