The CBIC and GSTN department have recently changed the format of the GSTR-3B to align it to the Input Tax Credit (ITC) as defined in GSTR-2B in alignment with GST Circular No: 170/02/2022.

According to the new changes, the recipient must claim an input tax credit based on the GSTR2B data and reverse it for supplies not received by him or in transit.

The recipient can reclaim the GST input tax credit already reversed in GSTR3B once the supplies are received.

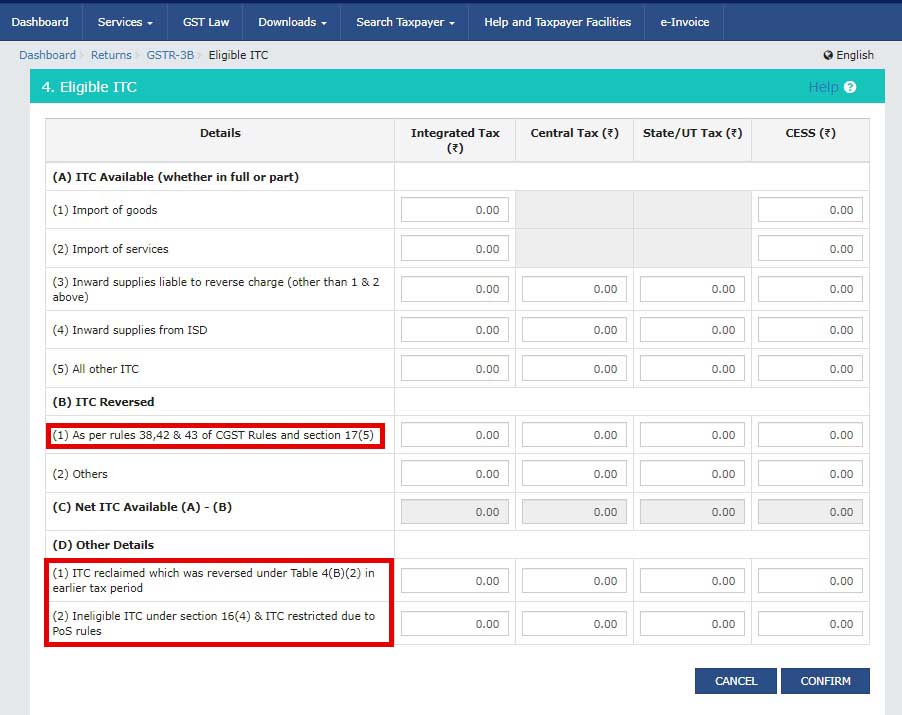

GSTR3B Table 4A should reflect the GSTR2B ITC alone, while GSTR3B Table 4D should reflect any reversals and reclaims declared.

Changes in the Eligible ITC Section of Form GSTR-3B

GSTN may soon disable editing of auto-populated values in Table 4A of GSTR3B since we need to display reductions and all additions only in Table 4D.

As of July 31st, the CBIC and Finance Ministry missed a lot of issues related to pending GST ITC due to the alignment of form GSTR-3B with the GSTR-2B form.

Read Also:All GSTR-3B Changes for Accurate Eligible ITC Calculation

On July 31st, the assessees had been claiming ITC according to their books since the GSTR-2B will only have ITC related to filings made during that period.

There will obviously be some ITC available in subsequent months only if the geographical area of the country requires days or weeks to transport goods. Thus, GSTN encouraged the editing of auto-populated data and claimed ITC accordingly.

Using the GSTR-2B form, which is the filing data for the specific month, the ITC related to the previous period has to be claimed in Table 4D as "reclaim of ITC already reversed". As of now, there has been no ITC reversal done earlier for "reclaiming".

In Light of CBIC's Lack of Clarity, Assessees are Only Allowed to Adhere to the New Compliance as Follows:

- In Table 4A of GSTR3B, you will be able to claim ITCs based on GSTR-2B of August 2022

- Reverse all claimed input tax credits already for which supplies have not been received / vendors have not filed their returns in Table 4(D)(2) of GSTR3B.

- The reverse ITC can be claimed from the September return onwards as soon as the supplies have been received or Vendors have filed their returns in Table 4(D)(1) of form GSTR-3B.

In this case, the ITC as defined in GSTR-2B will be reported in Table 4A of GSTR3B, and adjustments supplies like reversals not obtained and reclaims for supplies accepted against old reversals can be reported in form GSTR-3B of Table 4D.

This process is only to clarify how to adhere to the new requirement in GSTR-3B without getting into litigation.

However, experts suggest that we should wait for official clarification of the ITC to be claimed in the GSTR-3B for August 2022 returns by CBIC.

Comments

Post a Comment