Taxpayers using the e-filing portal of the Income Tax department can correct any errors when filing income tax returns (ITRs). If users filing the incorrect information are entered, taxpayers, besides receiving a legal notice from the income tax department, also risk losing their income tax refunds. Such as salaried people should, they can be extremely careful while filing/her income tax return and after then submitting the tax return, check if all tax information regarding the form were correct, and rectify errors if any.

Read also: Simple Way to e-file Tax Rectification Request U/S 154 on Portal

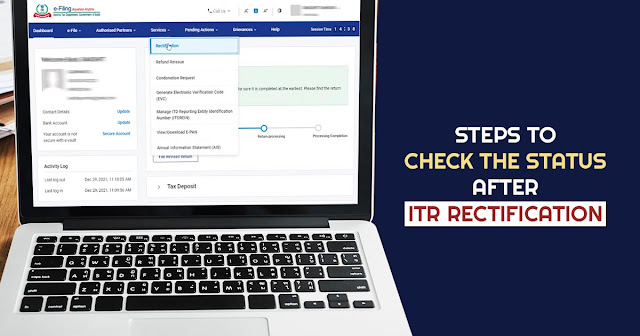

In some cases, taxpayers can also check up on the rectification status on the new Govt portal. Let’s follow some important steps such as:

- Go to https://www.incometax.gov.in/iec/foportal new portal

- In this second step, click on ‘ITR portal dashboard’ and then 'Services', 'Rectification Request' and Rectification Status'.

- In this third step, click on ‘Rectification Request Number’ to see the rectification information.

- After then against the request number, go to ‘View Details’ option

- Status of Submitted will be displayed for the request

- Completed/Rejected/In Progress/Condonation of Delay Request Accepted/e-submission re-enabled by AO.

Comments

Post a Comment