Towards the matter in which the taxpayer has wrongly entered the information of the tax furnished, he or she would receive the tax credit mismatch notice beneath income tax section 143(1) (a).

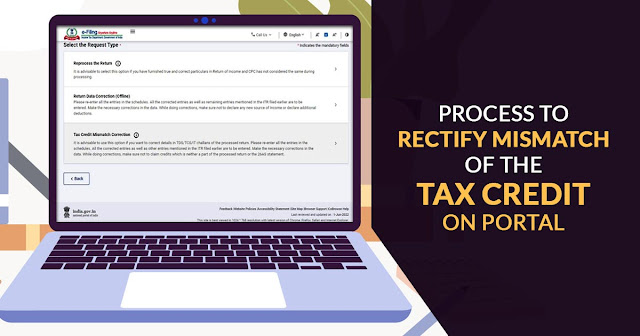

Mechanism to Improvise That in The Updated Income Tax Portal

Step 1: Post to login to the income tax portal, go to service then tap on the rectification option which is being shown in the service bar.

Step 3: Choose the assessment year for which the notice is provided to the taxpayer.

Step 5: An individual shall obtain the information of the challan already inserted during the furnishing of the income-tax return, there is a choice to edit the information such as the amount, date, BSR code, and others.

Step 6: Post the successful submission, you would obtain the rectification reference number for the subsequent resemblance.

Comments

Post a Comment