Under GST when the dealer wants to choose the composition scheme, they need to intimate the government for this. The same would be done through furnishing the Form GST CMP-01 or Form GST CMP-02.

CMP-01 is the form which is to be furnished via migrated assessee who are urged to choose for the composition scheme. The due date for the same was August 1, 2017 (1 month from July 2017). The assessee who likes to choose the composition scheme for the fiscal year or in the middle of the fiscal year needs to tell the government about their preference. The same would be performed via furnishing the GST CMP-02 when the CMP-02 has been furnished in the middle of the fiscal year, the law of the scheme is subjected to apply from the month after the succeeding the month where CMP-02 has been furnished.

For instance, the assessee furnishes the CMP-02 in the month of December 2017, and it pointed out that the compliance of the composition scheme would be subjected to apply from January 2018. Both CMP-01 and CMP-02 are needed to be furnished online on the GST portal or GSTN and the procedure to furnish that is similar.

Below is The Guide to Furnishing The GST CMP-02 on The GST Portal

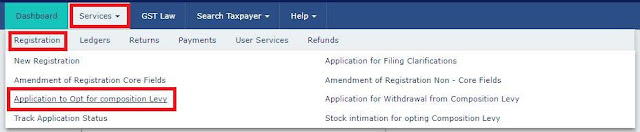

Step 1. log in to the GST Portal.

Step 2. Go to ‘Services’ > ‘Registration’ > ‘Application to Opt for composition Levy’.

Step 3. On this window read the composition declaration along with the verification and tick the checkbox. Opt the ‘Name of Authorized Signatory’ from the drop-down. Also, type the ‘Place’ and click on ‘SAVE’.

Step 4. If you are a company or an LLP then you can only submit the application with GST return filing DSC. Any additional registrant would use any of the 3 modes for submitting the return.

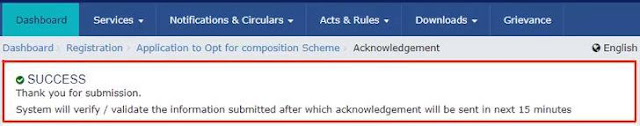

Step 5. A pop-up prompt retaining the warning. Tap on ‘PROCEED’ here.

Once the application delivers a success message is shown. Indeed an acknowledgement is been sent to your enrolled email id and mobile.

Post to filing this form a composition dealer needs to furnish GST CMP-03 within 90 days.

Comments

Post a Comment