Gen XBRL is a complete software for validating and preparing XBRL sheets for accounting and taxation professionals, including company secretaries (CS) and chartered accountants (CAs). It is well known that CS and CAs spend a lot of time preparing and e-filing the balance sheets, profit & loss a/c calculation based on the new XBRL format, etc. Therefore, using Gen XBRL software is a great idea for accounting professionals to perform the above-given tasks in a few easy steps.

Gen XBRL software also allows CA and CS professionals to prepare XML sheets based on the latest Indian accounting standard (IND AS). This MCA business rule-based software gets regularly updated and is also extremely easy to use for accounting professionals. With the help of Gen XBRL return filing software, the professionals can easily perform the import and export of current and previous year XML and also validate it directly with other vendors' software.

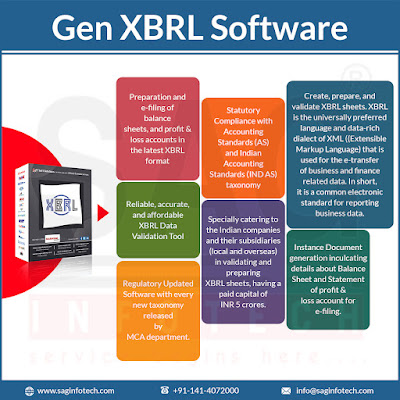

Here is a list of some of the most attractive and useful features offered by Gen XBRL software:

- Preparation and e-filing of balance sheets, and profit & loss accounts in the latest XBRL format

- Statutory Compliance with Accounting Standards (AS) and Indian Accounting Standards (IND AS) taxonomy

- Create, prepare, and validate XBRL sheets. XBRL is the universally preferred language and data-rich dialect of XML (Extensible Markup Language) that is used for the e-transfer of business and finance-related data. In short, it is a common electronic standard for reporting business data.

- Regulatory Updated Software with every new taxonomy released by the MCA department.

- Reliable, accurate, and affordable XBRL Data Validation Tool

- Especially catering to the Indian companies and their subsidiaries (local and overseas), invalidating and preparing XBRL sheets, having a paid capital of INR 5 crores.

- Instance Document generation inculcating details about the Balance Sheet and Statement of profit & loss account for e-filing.

Comments

Post a Comment