Instead of starting the new GST return filing system, the government shall try to begin the new specifications to the traditional system. Here is the whole guide to download the excel file of GSTR 2B from the GST portal which is available in JSON for import data.

The excel file of the GSTR 2B assists us to build the reconciliation in a simpler way and the JSON file assists us to import the information to any software.

The Procedure Which Guides Us:

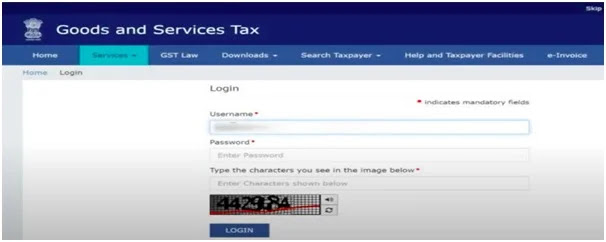

Step 1: Log in to the new GST portal by entering the username and password, Tap on login.

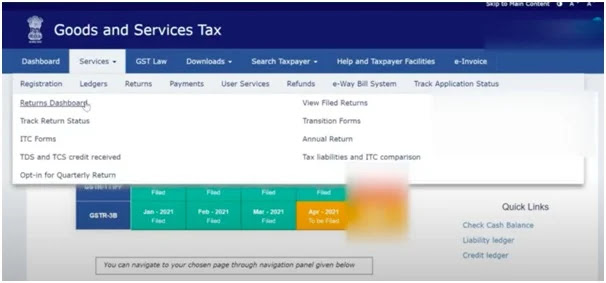

Step 2: Post tapping the log in the dashboard shall be displayed and then tap on the service then opt for the return and then tap on the return dashboard.

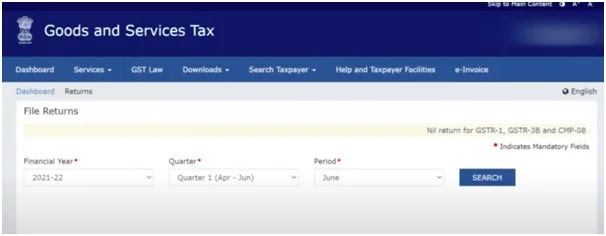

Step 3: Now you shall need to furnish the details towards the FY quarter and period. Post to furnish the entries tap on search.

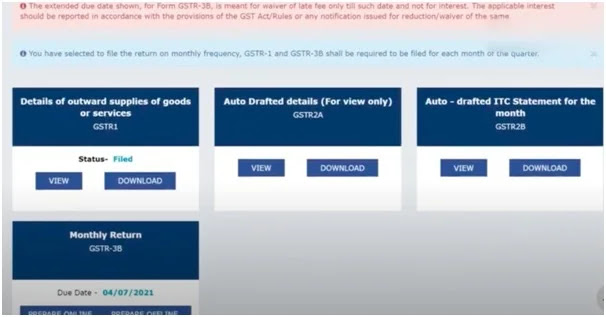

Step: 4: Now scroll down and choose the auto-drafted input tax credit (ITC) statement on GSTR-2B then opt for the download option.

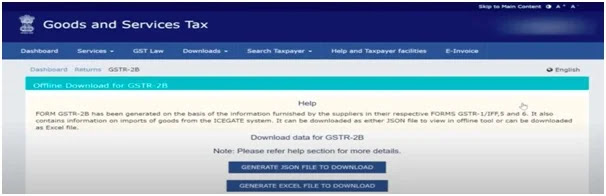

Step 5: The last thing is that you must have the choice to download the GSTR-2B in excel format or in JSON format.

Comments

Post a Comment