Form GSTR-2A is meant for the filing of inward supply for a receiver taxpayer. Form GSTR-2A is available in the view-only mode for a certain period of time. It is created for a recipient when the Form GSTR-1 or 5,6, 7 and 8 is filed and submitted by the supplier taxpayer.

If you need to view the Inward Supplies Details in the Form GSTR-2A, some simple steps are needed to be followed.

The Steps Can be Enumerated as Follows:

- Step 1: Visit the website www.gst.gov.in. The GST Homepage will be displayed.

- Step 2: Login to the GST Portal with valid credentials.

- Step 3: Click Services>Returns> Returns Dashboard

- Step 4: Now select the Financial Year & Return Period (Month) for which you want to view Form GSTR-2A from the dropdown list.

- Step 5: Now click on the Search file.

- Step 6: Then File Returns page will be displayed

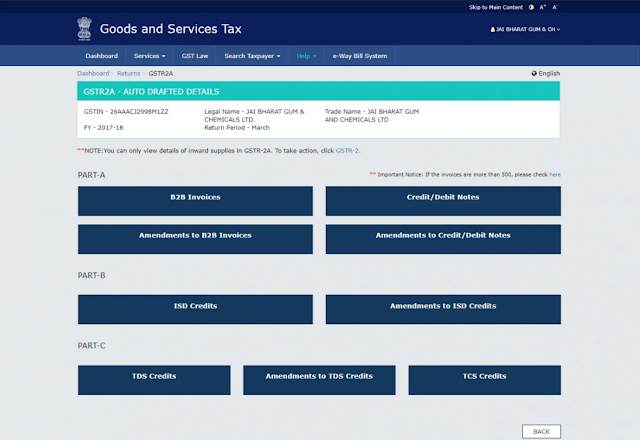

- Step 7: Now GSTR-2A can be seen as auto drafted supplies and can be downloaded from the icon download GSTR-2A. Here two options are given either to download the file in excel format or Jason file format.

It may take up to 20 minutes for the file to be generated and downloaded.

- Step 8: In order to open the file in a view-only format, Click The Form GSTR-2A View option.

The Form GSTR- 2A auto-populated details will be visible here.

These details can help you view the Inward Supplies details in Form GSTR-2A

Comments

Post a Comment