Before developing a CA/CA firm website, you need to follow the guidelines of ICAI (Institute of Chartered Accountants of India).

The Institute of Chartered Accountants of India (ICAI) prohibits the members from promoting their work by advertising, circular, personal communication and by other medium. The ICAI, under the Chartered Accountant Act, 1949 has laid down its guidelines to post their particulars on the website.

Recently, the council has made some changes to the sub-Clauses (8) or (20) of the existing guidelines. In the updated guidelines, the sub-clause (8) will permit for the display of passport size photograph and sub-clause (20) will provide the links of the Canadian Institute of Chartered Accountants (CICA), The Institute of Chartered Accountants of England and Wales and American Institute of Certified Public Accountants (AICPA).

The revised guidelines with complete description are available in the PDF format for the Chartered Accountants/Firms of Chartered Accountants websites.

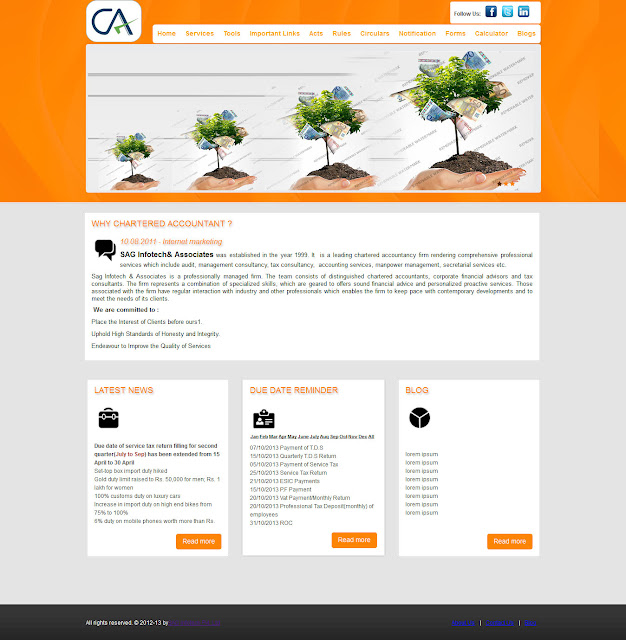

Our company “SAG InfoTech” provides the services for CA/CS website development under the guidelines of the ICAI. The CA/CS portal contains firm information, login panel, inter connectivity, utilities like auto calculator, department link gallery, links, acts, Vat utility and much more. As per the requirement of CA/CS, we can also make changes or modifications in the website.

The Institute of Chartered Accountants of India (ICAI) prohibits the members from promoting their work by advertising, circular, personal communication and by other medium. The ICAI, under the Chartered Accountant Act, 1949 has laid down its guidelines to post their particulars on the website.

Recently, the council has made some changes to the sub-Clauses (8) or (20) of the existing guidelines. In the updated guidelines, the sub-clause (8) will permit for the display of passport size photograph and sub-clause (20) will provide the links of the Canadian Institute of Chartered Accountants (CICA), The Institute of Chartered Accountants of England and Wales and American Institute of Certified Public Accountants (AICPA).

The revised guidelines with complete description are available in the PDF format for the Chartered Accountants/Firms of Chartered Accountants websites.

Our company “SAG InfoTech” provides the services for CA/CS website development under the guidelines of the ICAI. The CA/CS portal contains firm information, login panel, inter connectivity, utilities like auto calculator, department link gallery, links, acts, Vat utility and much more. As per the requirement of CA/CS, we can also make changes or modifications in the website.

Comments

Post a Comment