There were days when the taxpayers had to file the tax through his/her hands but as the days passed, technology grew and many software were developed. One of that software is ‘Gen CompLaw’ by which you can file the MCA as well as the ROC filing software. There are several ROC filing software in the industry but Gen CompLaw software is one of the best software in the market.

What is Gen CompLaw Software?

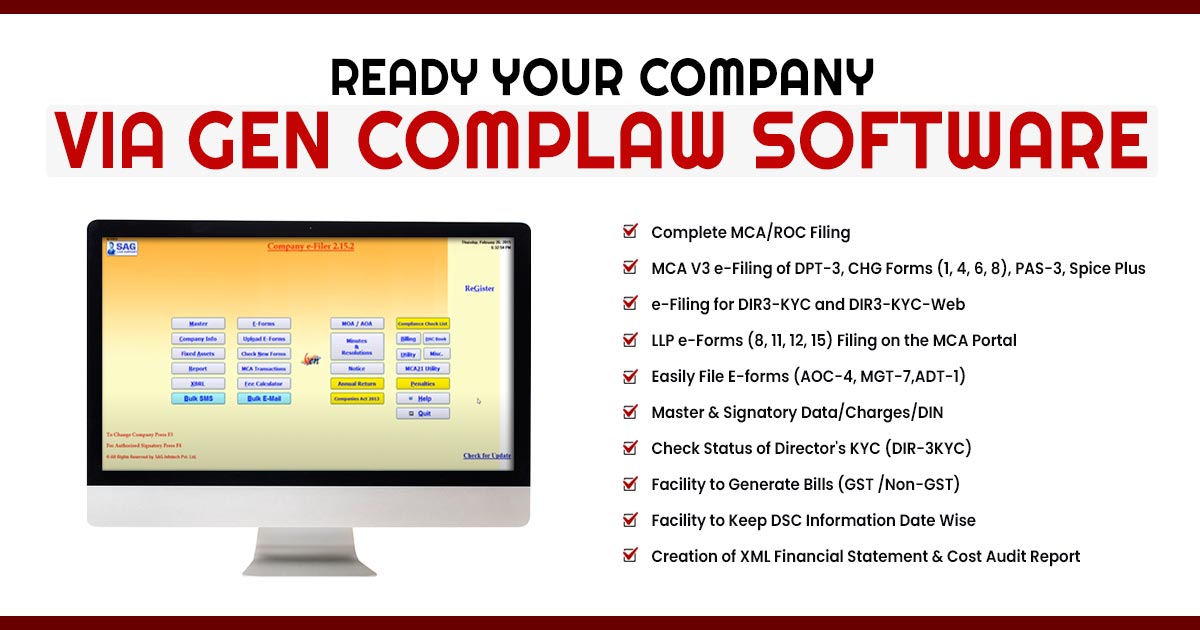

Gen Company Law is among the leading software which deals in taxation. With the help of this software, we can do the following things-- Complete ROC/MCA Filing

- XBRL Resolutions

- Various MIS Reports

- AOC-4, MGT-7, MGT-7A, ADT-1

- LLP (3,8,11,12,15) E-filing Form

- CHG-1, 4, 6, 8 Forms

- DIR-3 and DIR-3 KYC Web Form

- e-Filing of MCA V3 Forms

- DIR 3, 5, 6, 11

SAG Infotech Pvt. Ltd. offers the Gen CompLaw with XBRL at the installation price of INR 20,000 while the yearly updation is INR 8,000. It offers quick XBRL e-filing. The company has also brought the Gen CompLaw without XBRL software at the installation cost of INR 10,000 and yearly updation at INR 4,000. It is efficient, faster, provides better performance, and has limitless scope.

Benefits of Gen CompLaw Software

What Are The Benefits of Gen CompLaw Software?

Benefits of the Gen CompLaw Software

- MCA/ROC Filing

- Lates E-forms

- Meetings, Notices, Agenda, Minutes

- Software Updates

- Fixed Assets Register

- Reports and Certificate

- Import – Export Option Facility

- Master & Signatory Data/Charges/DIN

- Status of Uploaded E-forms

- Regular Updates

- Compliance Reminder

- Bulk SMS / Emails

- Status of E-form DIR-3KYC

- Compliance Check List

- GST/Non-GST Billing

- Maintenance of DSC Book

- Helps the admin to manage the telephone directory.

- Helps the admin to manage the client and label printing easily.

- All the India STD codes are available.

- All the PAN/TAN codes, as well as BSR and bank branch codes, are available.

The admin has the facility to import and export balance sheet and loss account through MS-Excel respectively. Import convenience has the facility to import the profit and loss account from the 23ACA form and the balance sheet from 23AC. There is a feature for importing the master data from the MCA website. There is also a feature of extracting the master data of the company from the 20B form.

The master details can also be imported from form 23AC. The security check facility is given to the admin

For E-Forms:

The CompLaw software updates with the new Companies Act, 2013.

- Annual filing forms

- Compliance forms

- All charges forms

- Director forms

- Incorporation forms of the company

- Informational service forms

- Company registration forms

- Approval service forms

For ROC-filing:

The first thing to do is to fill out all the fiscal data with all applicable notes and declare it in the Excel sheet which is the latest taxonomy XBRL sheet download provided by us. Then, convert the XBRL software sheet into the XML file format through the Gen CompLaw software with the help of professionals. Now, check whether the data is valid or not through the MCA tool. For instance, the documents that have a profit and Loss Account and Balance Sheet will be generated for e-filing.

Similar: How to e-File AOC-4 Form By SAG Infotech's ROC Software

Attractive Benefits for The Users Include:

Attractive Benefits for The Users Include:

- The XBRL Taxonomy of MCA can be converted with a revised schedule, validation, Pre-scrutiny, and e-filing with the help of this software.

- PDF files can easily be generated.

- The e-forms can be signed digitally by the admin.

- The software gives permission to download all the latest e-forms which are also present on the MCA website.

- Documents that are automatically attached to the pdf file can be attached in the software by the admin.

- With the help of this software, the admin can create Directory, CA, Shareholder, CS master due to which the duplicate data is neglected.

- By this software, the data will not be repeated and the admin can create the masters with the facility of customization.

- Through this software, the excel files can be converted into the PDF.

- This software provides a facility of the free calculator.

- The admin can also log in as per the company.

- There is a feature of security checking.

- The admin can directly login into the MCA website for uploading the e-forms.

- The software can also create a backup as well as can restore the data.

- See the Free Demo of Gen Comp Law Software in Hindi

Read Also: Gen Comp law MCA return filing software

Comments

Post a Comment