Gen IT is one of the income tax software created by professionals from SAG Infotech Pvt. Ltd. This software helps to compute Income Tax, Interest Calculations, Advance and Self Assessment Tax. The software is created with high-quality perfection to prepare returns. It also provides e-filing to upload returns with the help of the software.

This software is proficient in calculating Income Tax, Advance, Interest Calculations, and Self-Assessment Tax. The quality of the software is very high, as the returns are prepared by it. The software provides the facility to file and upload returns. Also, there are simple steps to download the free Gen IT software for the trial version.

To complete the processes, the Gen Income Tax returns filing software has 2 different sections which include - Client Manager, Income Tax, Billing, AIR, Calculator, Backup/Restore, Password and Printer Settings, Bulk SMS/E-Mail and Help. These operations are explained briefly below-

1. Client Manager

This is the very first step in Gen IT as an individual can create new clients by providing details like name, residential and official address, client status, contact number, etc. One can also view, delete and change the clients from the list. The client group can also be created with the help of the Group Manager option. As per the individual's convenience, he can set the password as well as make changes in the advanced security settings.There is also a backup or restore option by which the individual can take a backup of the reports of the clients. The XML sheets can be imported with the help of the XML option, which is present in the Import Masters. For more help, click on the Help option in where you will get to know the do’s and don’ts to complete the procedure.

2. Income Tax

Many options in the income tax modules can be selected. In the Computation option, an individual has to fill in the details in the options like House Property, salary, Computation, e-Return Form, Tax details, and e-Return filing. In the audit information, one can fill Balance Sheets, profit and loss account information, with the mentioned options.- The user can print the Challan, generate reports or get the details in summary

- The user can also fill out the 49A and 48AA forms

- The user can also check the ITR-V and Intimation

3. AIR (Annual Information Return)

With the help of the AIR module, the user can get Forms 60, 61 and 61A. Other options include Branch Master, Additional Info, AIR, Party Master, and Utility. With this module, the user can also do the Annual Information Return.Read Also: How to Use Gen IT Software to E-file ITR 2 Form Smoothly

4. Calculator

There is a built-in calculator in the software by which the clients can easily fill out the working procedure.5. Backup/Restore

The backup or restore option helps the user to take the backup of any file or data and this can be done by just selecting its path. The data can also be restored.6. Password Settings

The user can generate the password for the selected module by the password setting module. Another module named the Printer setting module is on its way and by this module one can print any data.7. Bulk SMS/E-Mail

This module is extra that the company has provided its user or clients which is chargeable. This module allows the users to send SMS or emails to their clients just with a click.8. Help/Quit

In the Help or Quit option, the entire working procedure of the Gen Income Tax software is given in detail. The user who wants to activate the Gen IT can do so by clicking the Register option. This activation is done in just 3 simple steps. The procedure includes-- Select the online or offline registration at your convenience

- Fill up the activation code

- The software is activated

New Features of Gen Income Tax Software

As we discussed the Gen Income Tax return filing software, there are some new features added to it, which will be discussed in this post below:

Document Email Sending

There is a new feature introduced under Gen IT Software for clients, such as an email account manager, which provides on-time email notifications and allows the complete management of conversations with the parties via email.

Additional Reporting Tools

The summary details tab is fundamentally a consolidated report with customer details such as income, income tax, return details, and refund details displayed at one time. The user can easily access personal details like Code, Name, PAN, Income Tax details, Salary, House Property, Occupation, STCG, and other details. Details of the refund, such as status, amount, and date, are included in the return details. A consolidated report can be maintained by saving other details within the software for future reference.

Annual Information Statement and Taxpayer Information Summary

A new feature in the software is AIS/TIS, which stands for Form 26AS (Annual Information Statement) and Taxpayer Information Summary. A user can easily import the AIS/TIS from where the information can be updated, which will update the software with the latest client details.

Various details, such as TDS/TCS and SFT, will be updated. In addition to tax payment details, the Other Information tab gives the option to download AIS/TIS PDF files in the respective format with details of any specific year.

E-Pay Tax Facility to Bank Options

Additional bank options have been added to enhance the e-Pay tax facility, expanding the choices for electronic tax payments. This simplifies the payment process and eliminates the need for manual transactions.

Import Pre-filed ITR Data of All Forms

Users can now easily file income tax return forms by importing already filed data from the XML/JSON file.

There are some other important features are also available in Gen I-T software including advanced tax estimation, import data of form 26AS, TIS and AIS, auto return forms generation etc.

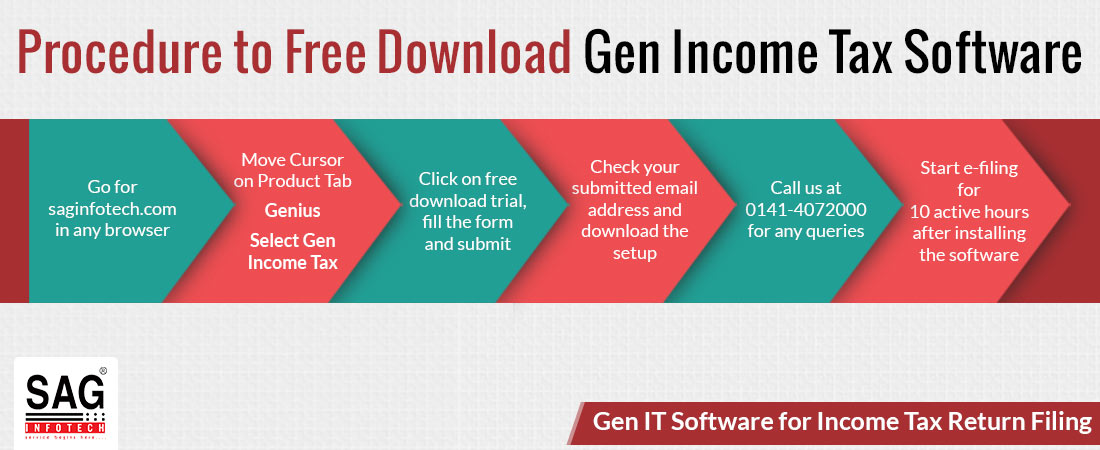

Simple Steps to Download a Free Trial of Gen Income Tax Software

- Start a browser and open https://saginfotech.com

- Take Cursor on Our Product Tab –> Genius –> Select Gen Income Tax software in the tab

- Now opt for the free download trial option, click on that option and fill in the required details in the form. After filling in the complete details, submit the form

- Check the given email ID, and find the link to download the setup

- For explanation of any difficulties, contact 0141 – 4072000

- You can begin e-filing after installing the software for 10 hours of installation

We have just found the amazing benefits of getting the best-in-class income tax software, i.e. the Gen IT software, which is also free to download on the official website. Check the complete advantages and procedures to download the free downloadable version of Gen Income Tax Return software with simple steps.

India's Top ITR E-filing Software for Chartered Accountants

Income tax returns don't need to be filed only from the official site of the CBDT. For this, some of the best software development companies are providing easy and simple ITR preparation filing software for chartered accountants and other professionals. In this article, we have mentioned India's top ITR filing software, which works finely as per the guidelines of Govt's new income tax portal, such as Gen income tax software, Govt JSON ITR utility, ClearTax software, Taxcloudindia, Webtel tax software, Winman tax software, HostBooks software, EZTax solutions, CompuTax software, Electrocom ITR software, and Saral tax software.

Comments

Post a Comment